Backed by 100+ years of combined expertise, our platform blends global best practices with academic rigour.

Learn risk management from professionals who shape both research and real-world strategy.” “We don’t just teach risk management — we live it. With over a century of combined experience and globally recognized experts, our programs turn complex risks into practical leadership insights.”

Basics of Risk Management

Master the Essentials of Risk Management with Our Expert-Led Program

In today’s volatile business environment, understanding risk is no longer optional — it’s a leadership imperative. Our comprehensive Risk Management Program takes participants on a transformative journey, starting with the fundamentals of what risk truly is and why managing it is critical for organizational success. You’ll explore the tangible benefits...

4+  (18,220 Learners)

(18,220 Learners)

Our Featured Courses

For Corporate rates to be discussed.

Please call or write an email info@msrisktec.com | +91 9015969007

FRM - Financial Risk Management

Innovative FRM Course with AI Integration

This innovative FRM course provides a comprehensive understanding of financial risk management, incorporating the transformative power of AI. It is designed to equip both practitioners and students with the skills needed to navigate the complexities of the modern financial landscape.

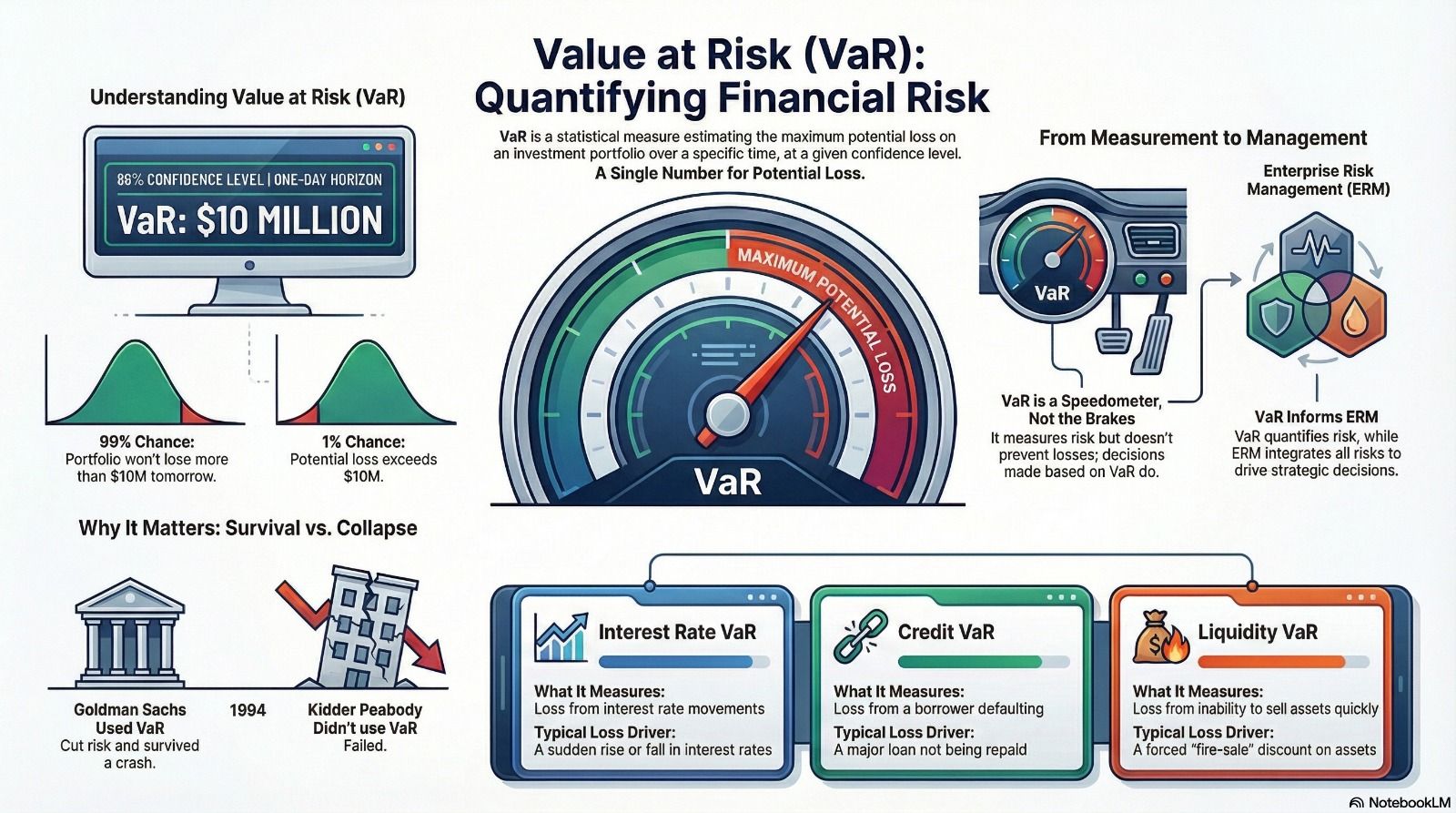

Value at Risk (VaR) as a key financial risk metric that estimates the maximum potential loss of a portfolio over a given time horizon at a specified confidence level. It highlights how VaR helps quantify risk (not prevent it), supports Enterprise Risk Management (ERM), and applies across market, credit, interest rate, and liquidity risks, emphasizing its role in informed decision-making and financial stability.

Frequently Asked Questions!

Still Have Questions?

Contact Us, We are happy to help you

What is risk management and why is it important?

How is Enterprise Risk Management (ERM) different from traditional risk management?

What are the benefits of effective risk management?

What frameworks are commonly used in risk management?

How do COSO and ISO 31000 differ?

COSO focuses on internal control and risk governance, often used in financial and compliance contexts. ISO 31000 provides broad guidelines applicable across industries and emphasizes a principles-based approach to managing risks.

Join our Course where creativity thrives.

Unlock the amazing benefits of joining our course, growing your skills, and building connections.

More Details Mail us: info@msrisktec.com